he Impact of the U.S. Real Estate Market Slump on KOSPI Overnight Futures

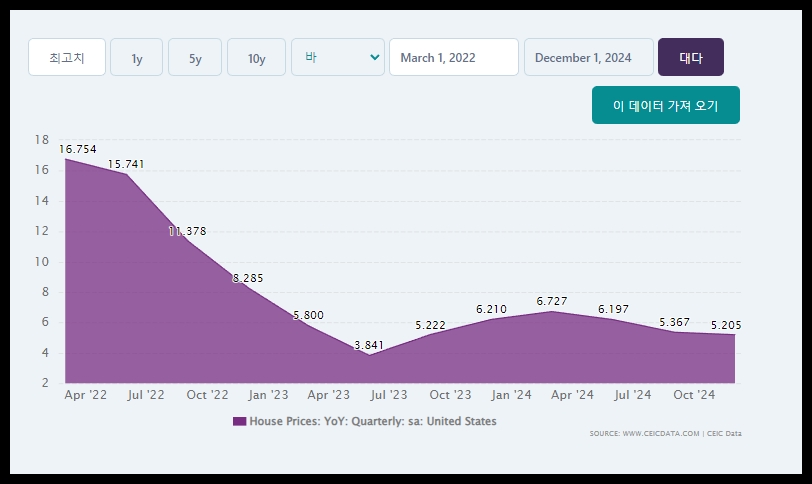

The U.S. real estate market has recently shown signs of significant weakness, which has sent shockwaves through both the U.S. stock market and global financial markets. The sluggish performance of the housing market, driven by a slowdown in new home sales and housing starts, has raised concerns about a potential economic downturn in the U.S. This, in turn, has caused a ripple effect, impacting markets far beyond U.S. borders.

As the U.S. stock market dropped in response to the real estate slump, international investors began to adjust their strategies, leading to a shift in global market sentiment. The U.S. economy is a major driver of global economic growth, and any signs of weakness in its real estate sector are viewed as a broader warning of possible economic challenges ahead.

The (KOSPI200 야간선물) market, which reacts to global economic changes, was not immune to this shock. Following the release of disappointing U.S. housing data, KOSPI overnight futures saw a decline, reflecting the global fear of a potential economic slowdown. As foreign investors responded to the U.S. market downturn by shifting their focus to safer assets, the KOSPI index followed suit with a negative trend in the overnight futures market.

This decline in KOSPI Overnight Futures highlights the interconnectedness of global markets. When major economies like the U.S. experience setbacks, especially in crucial sectors like real estate, it sends ripples throughout the global financial ecosystem, impacting markets in Asia, including the Korean stock market.

For investors, it’s essential to monitor the volatility in markets like KOSPI Overnight Futures, as these can provide valuable insights into the mood of the market before the domestic stock market opens. With global economic uncertainty increasing, having a keen understanding of how events in one major economy, such as the U.S., can influence others is crucial for making informed investment decisions.