Recently, KOSPI overnight futures have shown a decline, with the weak U.S. housing data being identified as the main cause. In this article, we will provide a detailed explanation of what KOSPI overnight futures and U.S. housing data are, and how they interact with each other.

What KOSPI overnight futures are

KOSPI overnight futures refer to futures contracts based on the KOSPI index, which is the representative stock index of the Korean market. A futures contract is an agreement to buy or sell an asset at a predetermined price at a specific point in the future. The overnight futures market is designed to allow foreign investors to trade the KOSPI index after the regular trading hours of the Korean stock market.

While the stock market typically closes at the end of the trading day, the overnight futures market enables foreign investors to make predictions or investments that could influence the Korean stock market according to their time zones, such as those in the U.S. or Europe.

These KOSPI overnight futures trades can be conducted through brokerage firms. For those interested, please refer to the (코스피 야간선물) website.

Since the movements in this market are primarily influenced by U.S. economic data or global economic conditions, the trends in the overnight futures market play a role in predicting the atmosphere of the Korean stock market before its opening on the next day.

Meaning of U.S. Housing Data

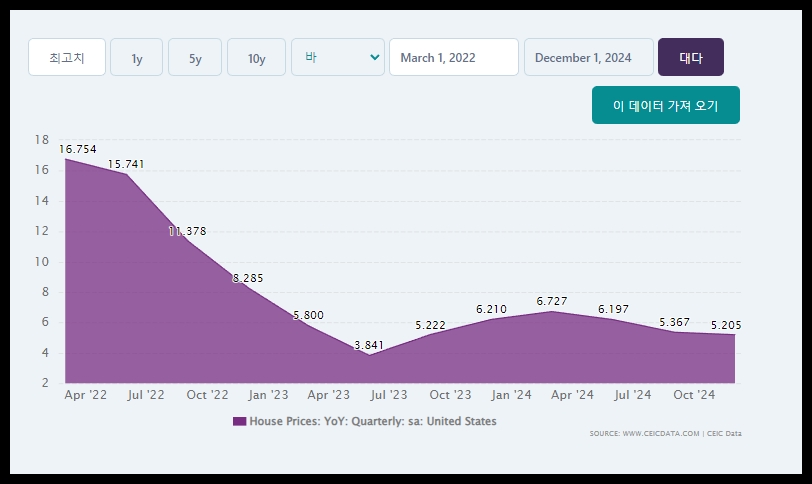

U.S. housing data refers to key economic indicators that assess the health of the housing market in the United States. These housing indicators include housing starts, new home sales, existing home sales, home prices, and housing indices. These metrics reflect the condition of the real estate market, which is a vital part of the U.S. economy, and can have a significant impact on the stock market and global economy.

The housing market plays a crucial role in economic growth. When housing construction is active, industries related to construction are stimulated, leading to job creation and increased consumer spending. On the other hand, when the housing market is sluggish, economic uncertainty grows, and there may be a decline in consumption and investment.

Impact of Weak U.S. Housing Data

When U.S. housing data is reported weakly, it can have a negative impact on global markets. Recently released U.S. housing indicators showed results worse than expected. In particular, housing starts and new home sales recorded lower figures, raising concerns about the slowing recovery of the U.S. economy. This, coupled with the continued interest rate hikes, could dampen consumer sentiment for home purchases and limit activity among construction companies.

The weakness in U.S. housing data amplifies concerns about the U.S. economy, leading to a stronger risk-averse sentiment in global financial markets. Investors may shift their funds to safer assets or become more cautious about the stock market, which can also affect Asian markets like the KOSPI.

KOSPI overnight futures decline

The recent decline in (야간선물) can be attributed to the weak U.S. housing data. Concerns about a downturn in the U.S. housing market were interpreted as a signal of global economic slowdown, causing investors to lower their sentiment toward the stock market.

In particular, KOSPI overnight futures are able to react immediately to the release of U.S. economic data. As news of the weak housing data spread, the KOSPI index showed a downward trend in the overnight futures market.

Additionally, the decline in the overnight futures market impacts the investor sentiment in the Korean stock market. With foreign investors exerting selling pressure on the KOSPI, it increases the likelihood of a negative sentiment forming in the market the day before the Korean stock market opens.

The Relationship Between the U.S. Economy and the Global Market

The weakness in U.S. housing data signals more than just a problem in the U.S. economy; it sends an important signal to the global economy. A downturn in the housing market, along with a contraction in consumption, can lead to concerns about widespread economic slowdown. This can have a negative impact on stock markets worldwide, with the Korean market being no exception.

Therefore, investors should closely analyze the volatility of U.S. economic indicators and develop more cautious investment strategies based on global economic trends. Monitoring the volatility of futures markets like KOSPI overnight futures will play an important role in predicting and preparing for the movements of the domestic stock market.